Deep|OpenAI: How Is OpenAI Eating the Enterprise SaaS TAM?

2026 Is OpenAI’s Year of Enterprise

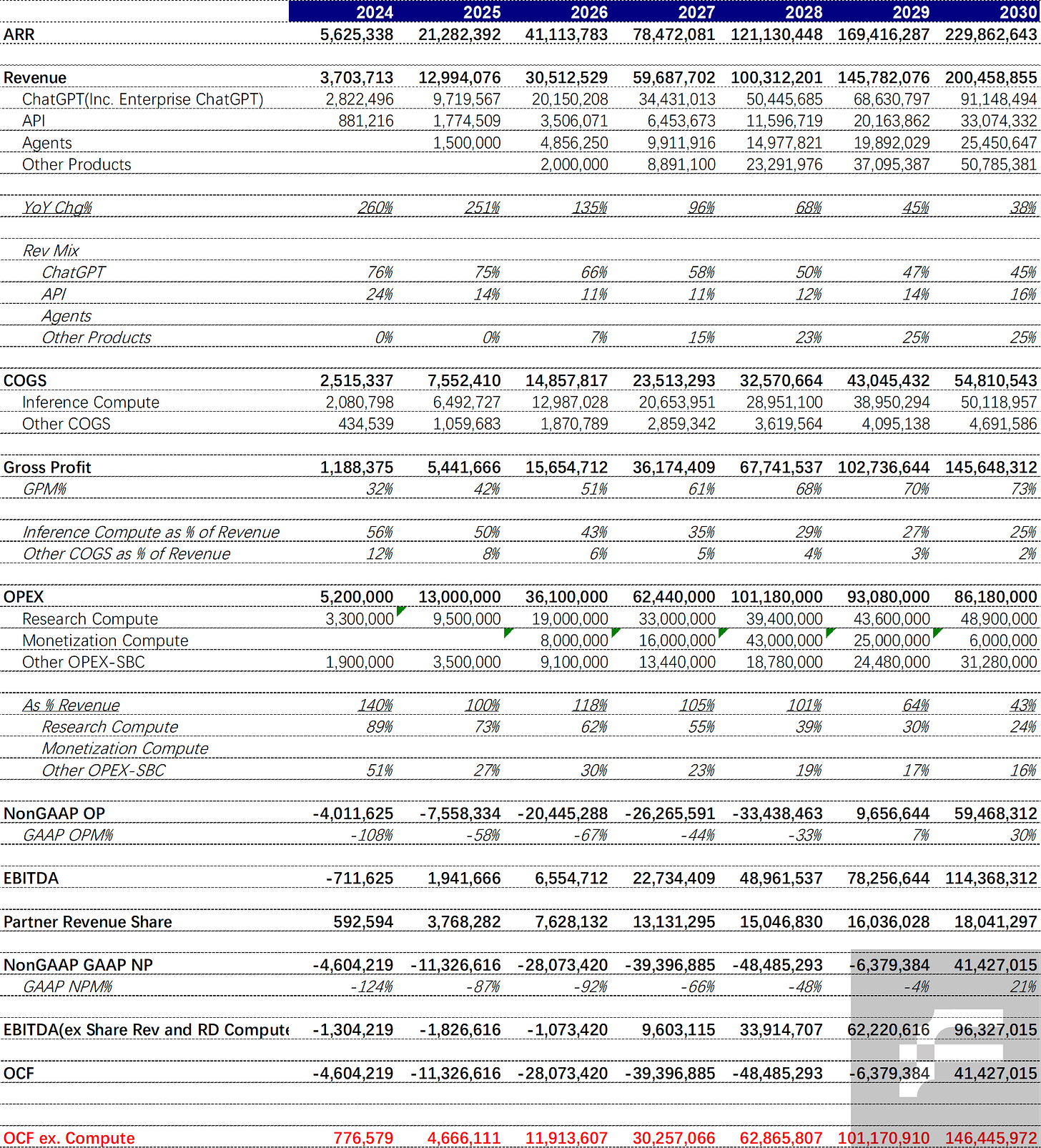

In our Deep|OpenAI: Can OpenAI Deliver on Its $1.4 Trillion CapEx Commitment? report, we conducted a detailed analysis of OpenAI’s revenue structure and cash flow position.

In this report, we examine how OpenAI will influence the AI narrative heading into next year. We’ll conclude by updating our monitoring of OpenAI’s user and paid subscriber metrics.

GPT 5.2 and OpenAI’s Enterprise Progress

In our MidTraining report, we provided a comprehensive overview of how MidTraining is impacting Labs’ resource allocation and its synthetic data generation logic.

It’s particularly important to note that OpenAI’s definition of MidTraining encompasses not only Continuous Training but also the majority of RL work. Under the new Frontier Researcher definition, the scope of MidTraining is expanding while PostTraining’s scope is contracting.

The new AI paradigm involves MidTraining continuously expanding across industries, beginning with Science, Finance, and Healthcare, landing in Enterprise, and creating new revenue growth curves for OpenAI.

Over the past three months, while Consumer Paid Subscriber growth has decelerated, ChatGPT for Enterprise has accelerated significantly. With its higher ARPU compared to ChatGPT for Consumer, OpenAI has maintained stable ARR growth. Enterprise revenue now represents an increasingly larger portion of OpenAI’s total revenue.

Let’s run some simple math to understand the industry implications

Assuming ChatGPT for Enterprise currently represents ~20% of ChatGPT ARR, this translates to approximately $2.5-3B ARR by year-end.

Considering their Agent product has another $2.5B ARR, OpenAI’s Total Enterprise Product ARR will reach nearly $6B by year-end, representing ~30% of Total ARR.

What will this look like in a year?

If OpenAI achieves its $30B revenue target next year and ChatGPT for Enterprise reaches 25% of ARR by year-end, ChatGPT for Enterprise ARR would hit $6B.

If OpenAI meets its ~$5B Agent revenue target next year, Agent ARR would reach $6.5B by year-end.

OpenAI’s Enterprise ARR would reach a staggering $12.5B by next year’s end.

$12.5B in Enterprise revenue is massive.

Despite Consumer revenue deceleration, if Enterprise revenue growth is driven by MidTraining and Vertical Agent capabilities, it undoubtedly signals that the new LLM paradigm is creating fresh revenue growth curves.

How OpenAI and Anthropic are Advancing Enterprise Products

OpenAI is currently working closely with PwC, Accenture, and Softbank, while Anthropic is partnering with Accenture. Both are exploring how to build customized products that ultimately lead to standardized offerings. Palantir followed a similar trajectory.

While the market is still discussing when OpenAI and Accenture will begin Enterprise work, they’ve already made significant progress...

There are many similarities to Palantir and MSFT Copilot Studio. We recommend reviewing our historical MSFT and PLTR Preview reports after reading this analysis.

We also extensively research Salesforce and ServiceNow Agent implementations quarterly. We suggest reviewing our CRM and NOW historical Preview reports as well.

Insights from a Former PwC Expert on Current Enterprise Progress

Division of Labor Between PwC and OpenAI

A typical PwC delivery team includes project managers, engineers, data engineers, and business analysts.

Data activation, RAG, and related work are handled by PwC. PwC identifies use cases, data structures, and sources, evaluates the nature of data to be ingested, then builds the platform for clients.

OpenAI focuses on the model and ensuring data accuracy.

OpenAI typically deploys a 3-person team during the solution design phase, usually lasting 3 weeks. Roles typically include a solution architect, OpenAI security expert, and model expert. For strategic multi-year projects like building data marts or data lakes, 6 weeks may be required. These 6 weeks don’t need to be consecutive.

OpenAI usually doesn’t participate in deployment, only returning for major troubleshooting or UI defects, though this is rare.

OpenAI is rapidly scaling their team to expand Enterprise business.

Current OpenAI-PwC Collaboration Across Four Key Areas

Customer Service

For clients already using ServiceNow, our OpenAI collaboration can’t replace ServiceNow. However, for mid-sized projects, OpenAI still plays a crucial role in building workflows, with SaaS platforms becoming part of the workflow.

CRM

Traditional CRM platforms require on-premise configuration, with all integrations completed at the client site—time-consuming and expensive for customization.

With OpenAI platforms, PwC typically deploys 10-12 person teams on-site, using OpenAI products for problem identification, solution design, and implementation. SaaS products become a small component of the entire workflow rather than providing end-to-end products like legacy SaaS platforms.

As processes mature or coverage expands, OpenAI can scale rapidly. Traditional platforms require going back to the vendor, explaining requirements, waiting for product customization and configuration. OpenAI scales faster and more cost-effectively. It’s scalable with higher turnover and provides senior management significant flexibility.

Knowledge Base

Back-office and Operations Automation

Including document management, KYC operations, onboarding, risk compliance, procurement, policy reporting, expense management, and receipt verification. Previously handled by back-office teams, now increasingly automated.

Specific Use Case Examples

Investor Relations and Investor Services

Clients frequently receive investor inquiries requiring responses within 24-48 hours. Previously, teams shared knowledge bases, searched documents, then drafted investor communications.

With OpenAI solutions, ChatBots provide answers within 30 seconds with source citations. Emails are auto-generated; clients simply approve and send. Beyond reducing response time from 24-48 hours to under an hour, accuracy is also improved.

KYC Automation

Helps clients understand investor profiles. Generates and sends emails requesting required documents. Once documents are received via email, they’re stored in shared folders.

From these folders, it extracts information and populates templates, then performs rule-based validation to flag correct or missing details. For any pending items, it sends follow-up emails to investors. This is the OpenAI plus workflow model we’ve built for clients.

Data Processing and Customization

Traditional SaaS platforms primarily handle structured data with very clear boundaries on capabilities.

70% of OpenAI use cases involve unstructured data. For OpenAI, this represents exploring new territory with infinite solution space, requiring testing to determine capabilities and limitations.

When clients make special requests to Salesforce, they assess market demand before building products to accommodate multiple players. But PwC can support high-variance workflows, delivering specific nuances—those non-standard, non-mass market requirements.

Salesforce can’t frequently modify products. Through OpenAI collaboration, PwC can quarterly assess client challenges, then adjust parameters, vectorization, and RAG platforms to meet client needs—all with rapid turnaround and cost-effectiveness.

Go-to-Market

Currently, PwC primarily engages clients. PwC first identifies use cases, diagnoses problems, obtains management buy-in, then proposes OpenAI-driven solutions.

“We typically show clients solutions we’ve already built for their competitors.”

20% of demand comes from PwC demonstrating that Salesforce still has many unresolved issues and that clients’ specific needs won’t receive Salesforce’s attention.

Other Advantages of OpenAI Solutions vs. SaaS

Traditional SaaS only works within client company systems, mostly small models with limited creativity. OpenAI solutions work across every client system with limited collaboration with external systems.

SaaS forces clients into predefined workflows. With OpenAI, clients can customize processes and integrations.

SaaS charges by module with expensive add-ons. OpenAI pricing is consumption-based, cheaper for large-scale use cases.

If productivity gains are clear, clients willingly pay more. AI consolidates multiple tools with visible, measurable business impact. This is how we discuss with clients.

Clients now turn to workflow-building solutions rather than traditional SaaS platforms, understanding that these SaaS modules may be replaced by AI platforms in 5-7 years, making OpenAI solutions a priority.

Deployment Timeline

Salesforce’s Agentforce typically requires 6 months for deployment due to extensive data cleaning requirements.

PwC’s OpenAI solutions deploy within 3 months and conveniently handle large volumes of unstructured data. This is also due to PwC’s more specialized teams.

The SaaS Dilemma

SaaS platforms struggle to bring full OpenAI capabilities to market due to self-cannibalization risks. They’ve invested billions in existing products. If they now tell clients to adopt their OpenAI modules, clients will question their traditional models.

They must integrate OpenAI with current products to prevent obsolescence. But if OpenAI dominates during integration, existing product credibility suffers.

We expect SaaS platform businesses to be impacted by OpenAI consulting. While ServiceNow and Salesforce will take time to see reductions, smaller platforms like Zoho may see immediate business decline.